What is coinsurance and how does it work?

With today’s high inflation and the cost of commercial property insurance skyrocketing, many property clients are overlooking the need to update the replacement value on their property. This can be dangerous due to a clause that is included in all property insurance policies, the coinsurance clause.

The coinsurance clause states that you must cover the building to at least 80% of the replacement value of the property (at times, you will also see 90% and 100%). This is done to ensure that the company receives a fair premium for the risk. In North Texas and other catastrophe prone areas, insurers are increasingly requiring you to insure your building to 100% of the replacement value. However, if your policy has been in place for a while and you or your agent has not done a review on the replacement value, you could be at risk.

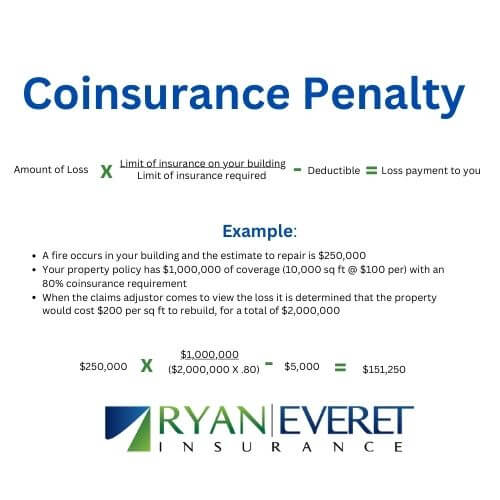

In order to help understand the coinsurance penalty on a partial loss, below is an example of the formula and then how it could be applied to a partial loss.

If you are concerned about your coverage speak to your insurance agent today. We have tools available to help calculate the replacement value on your building to ensure this will not happen to you!

To learn more about the state of property insurance, please be sure to watch this video and read our post: Commercial Property Trends in North Texas