Home inspections AFTER you buy

A home insurance inspection is requested after you have initiated a home insurance policy by the insurance company to make sure that the home is in insurable condition. If there are items found during this inspection that raise an eyebrow, the underwriter with the insurance company will typically request it to be corrected within 30-45 days before the policy is canceled and you’re left looking for a new policy.

Here are a few examples of the common issues we see that need to be addressed before you buy a home if you can negotiate it with the seller while still in the purchasing process:

- Trees needing to be trimmed away from the roof. Trees that are within 2 -3 feet of the roof need to be trimmed back to avoid the branches scraping the shingles and eventually causing a roof leak.

- Sidewalk or driveway tripping hazards. If a tree root or ground settlement has caused your sidewalk, patio, or driveway to shift, it could create a tripping hazard and a liability claim if someone is hurt on your property. This can usually be solved by adding some concrete to fill in the gaps and smooth the transition.

- Fence is leaning. A leaning fence is another possible liability issue since it could fall at any time or with a strong wind and damage someone else’s property or cause bodily harm.

- Steps need a handrail. If there is a sidewalk, patio, or deck with more than about 3 steps and no handrail, most insurance companies will require one to be installed.

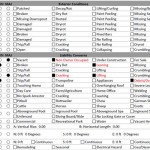

Click on the thumbnail below to view a sample insurance inspection form to see a checklist of some items reviewed during a home insurance inspection: